The Single Strategy To Use For San Diego Home Insurance

Safeguard Your Home and Loved Ones With Affordable Home Insurance Coverage Program

Relevance of Affordable Home Insurance Policy

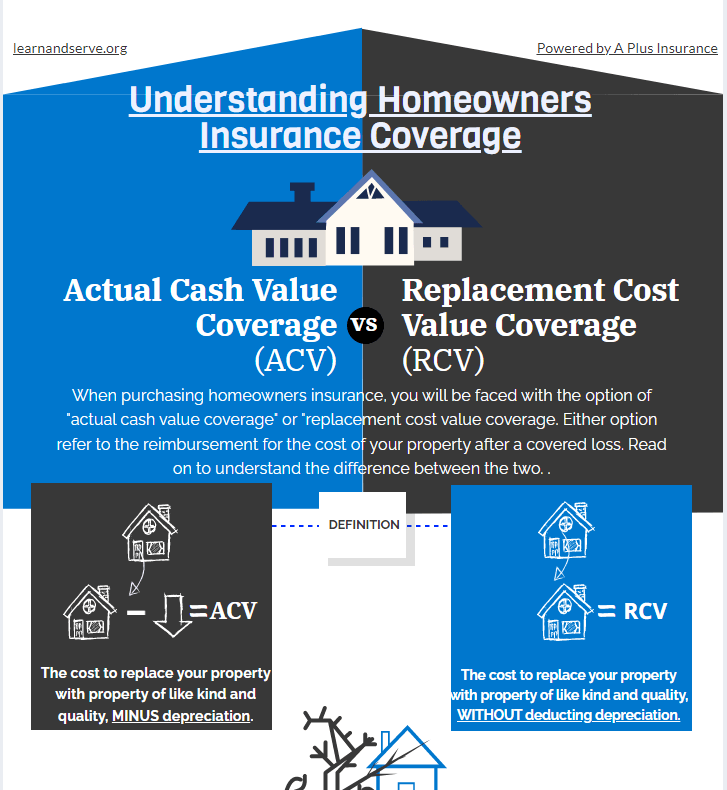

Securing affordable home insurance is crucial for protecting one's residential property and monetary wellness. Home insurance policy provides defense against various threats such as fire, burglary, all-natural calamities, and personal obligation. By having a thorough insurance coverage strategy in area, property owners can relax assured that their most significant investment is secured in the occasion of unpredicted circumstances.

Budget friendly home insurance coverage not just provides monetary safety and security however also provides assurance (San Diego Home Insurance). Despite increasing building values and building and construction costs, having a cost-efficient insurance coverage makes sure that homeowners can conveniently restore or repair their homes without facing substantial monetary worries

In addition, economical home insurance policy can additionally cover individual items within the home, using compensation for things damaged or swiped. This protection expands beyond the physical framework of your home, shielding the materials that make a house a home.

Protection Options and Purviews

When it pertains to protection limitations, it's vital to recognize the optimum amount your plan will certainly pay out for each kind of coverage. These restrictions can differ depending on the plan and insurer, so it's vital to review them meticulously to guarantee you have sufficient protection for your home and properties. By comprehending the protection choices and limits of your home insurance coverage, you can make educated decisions to guard your home and enjoyed ones successfully.

Elements Influencing Insurance Prices

A number of variables considerably affect the expenses of home insurance policy plans. The area of your home plays an essential duty in figuring out the insurance coverage costs. Homes in locations vulnerable to all-natural disasters or with high crime prices commonly have higher insurance policy costs due to boosted threats. The age and condition of your home are additionally aspects that insurers consider. Older homes or residential or commercial properties in bad condition may be a lot more expensive to insure as they are much more susceptible to damage.

Additionally, the kind of insurance coverage you select directly influences the expense of your insurance coverage policy. Choosing for additional protection choices such as flooding insurance policy or earthquake insurance coverage will boost your premium.

Additionally, your this content credit history, claims background, and the insurer you select can all influence the price of your home insurance coverage. By thinking about these variables, you can make educated choices to help manage your insurance costs properly.

Contrasting Service Providers and quotes

Along with contrasting quotes, it is vital to evaluate the reputation and financial stability of the insurance coverage suppliers. Try to find consumer reviews, ratings from independent companies, and any kind of history of complaints or governing activities. A trusted insurance policy supplier must have a good performance history of promptly refining cases and giving exceptional customer support.

Moreover, think about the particular protection features supplied by each supplier. Some insurance providers may use fringe benefits such as identification burglary protection, equipment failure insurance coverage, or insurance coverage for high-value products. By thoroughly contrasting quotes and companies, you can make an informed decision and choose the home insurance coverage plan that best satisfies your demands.

Tips for Reducing Home Insurance Policy

After extensively comparing quotes and service providers to discover one of the most suitable protection for your needs and spending plan, it is prudent to explore efficient approaches for reducing home insurance policy. One of one of the most significant methods to save money on home insurance is by bundling your policies. Numerous insurance firms use price cuts if you buy multiple plans from special info them, such as combining your home and auto insurance policy. Enhancing your home's protection measures can also bring about savings. Installing protection systems, smoke detectors, deadbolts, or a lawn sprinkler system can lower the risk of damages or burglary, potentially reducing your insurance coverage premiums. In addition, maintaining an excellent credit report can favorably influence your home insurance prices. Insurance providers typically take into find more consideration credit report when figuring out costs, so paying bills in a timely manner and handling your debt responsibly can result in reduced insurance policy prices. Lastly, routinely reviewing and upgrading your policy to show any kind of modifications in your home or situations can ensure you are not paying for protection you no more demand, assisting you conserve money on your home insurance coverage costs.

Conclusion

To conclude, protecting your home and enjoyed ones with affordable home insurance coverage is important. Recognizing protection alternatives, elements, and limitations affecting insurance coverage prices can assist you make educated choices. By comparing quotes and suppliers, you can find the very best plan that fits your needs and budget. Implementing suggestions for saving on home insurance can additionally aid you secure the required security for your home without breaking the bank.

By deciphering the intricacies of home insurance strategies and discovering sensible strategies for protecting inexpensive coverage, you can ensure that your home and enjoyed ones are well-protected.

Home insurance policy plans usually use several coverage alternatives to secure your home and personal belongings - San Diego Home Insurance. By comprehending the coverage choices and limitations of your home insurance plan, you can make informed choices to secure your home and loved ones properly

Consistently examining and updating your plan to show any adjustments in your home or situations can guarantee you are not paying for protection you no longer need, aiding you save cash on your home insurance coverage costs.

In final thought, protecting your home and enjoyed ones with cost effective home insurance policy is vital.